How to organize your bookkeeping for the corporation

Lets develop a system which handles your bookkeeping whether you are just starting out or you are trying to get back on track, here is the steps to get your on the right track.

The Art of Expense Tracking: Tips for Efficient Bookkeeping

Putting off the bookkeeping will start to pile up and become a unmanageable task. This can lead to late filings and expensive penalties from the Canada Revenue Agency. Let’s avoid those penalties and put those funds back into growing the business!

Stress free solutions for small businesses: Part 2 - FAQs

The truth is, good bookkeeping is powerful! Let us show you the difference. We try to make this process easy for you and work with you to come up with the best solution for your needs. Every business is unique, and your bookkeeping services should be too.

Stress free solutions for small businesses: Part 1 - The Process

The truth is, good bookkeeping is powerful! Let us show you the difference. We try to make this process easy for you and work with you to come up with the best solution for your needs. Every business is unique, and your bookkeeping services should be too.

How do you pay yourself from the corporation?

How do you pay yourself from the corporation? Did you know it could be a mix of both and it should be based on your business and goals.

Forth Quarter

Set yourself up for success in Q4. First, get the bookkeeping caught up and then make a plan how to distribute any additional profit in 2022 or 2023.

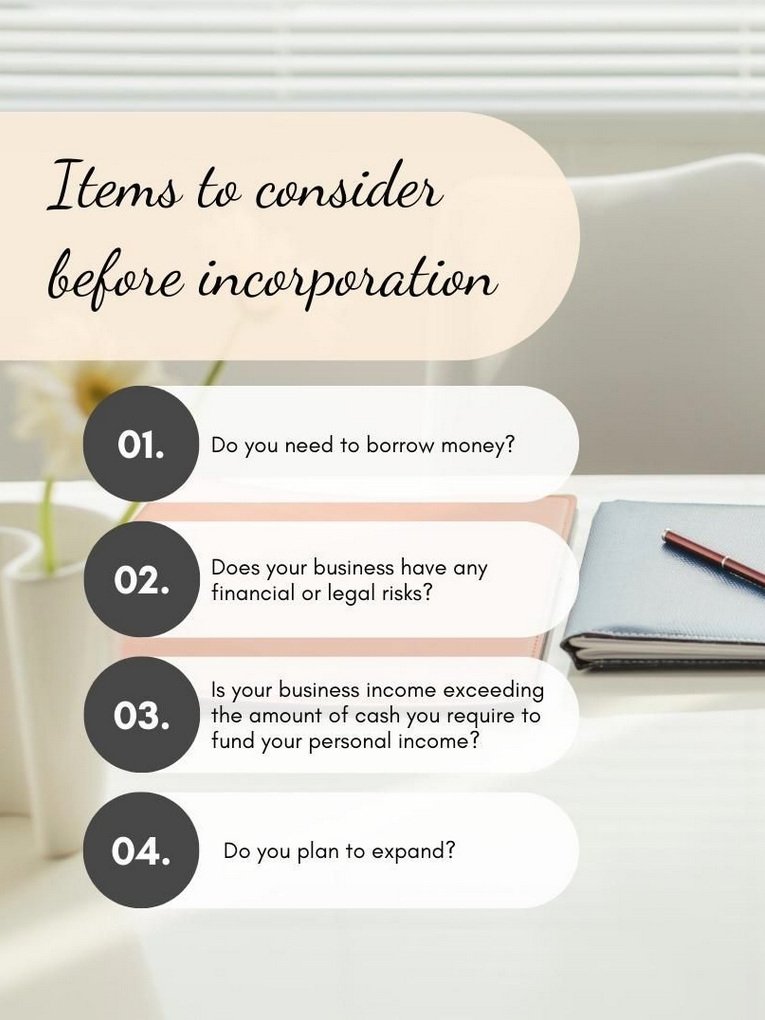

Items to consider before incorporation.

As a corporation, you can be separate from the business and therefore, determine how much income you wish to take from the corporation. You must declare all income that is taken from the entity for yourself personally, to record on a personal tax return. This is done by way of a T4/T5 filing requirement in February each year.

What to provide the accountant at year end.

What to provide the accountant at year end. Ever wonder what you should be providing to the accountant with your year end? Here is a quick snapshot of what an accountant needs.

What Is A CAPITAL ASSET and why do you need to track them separately for accounting?

What Is A CAPITAL ASSET and why do you need to track them separately for accounting? A capital asset is a purchase which gives a lasting benefit or advantage. The useful life of this purchase exceeds one year and is not intended for sale in the regular course of the operations.

Business Expenses - Motor Vehicle Expenses

You can deduct expenses you incur to run a motor vehicle that you use to earn business income. However, several factors can affect your deduction and the supporting documentation required does depend on the business structure.

5 things to consider when hiring an accountant

When choosing an accountant, they should be a good fit for your business. Here is a few things to consider when having an initial meeting with an accountant.

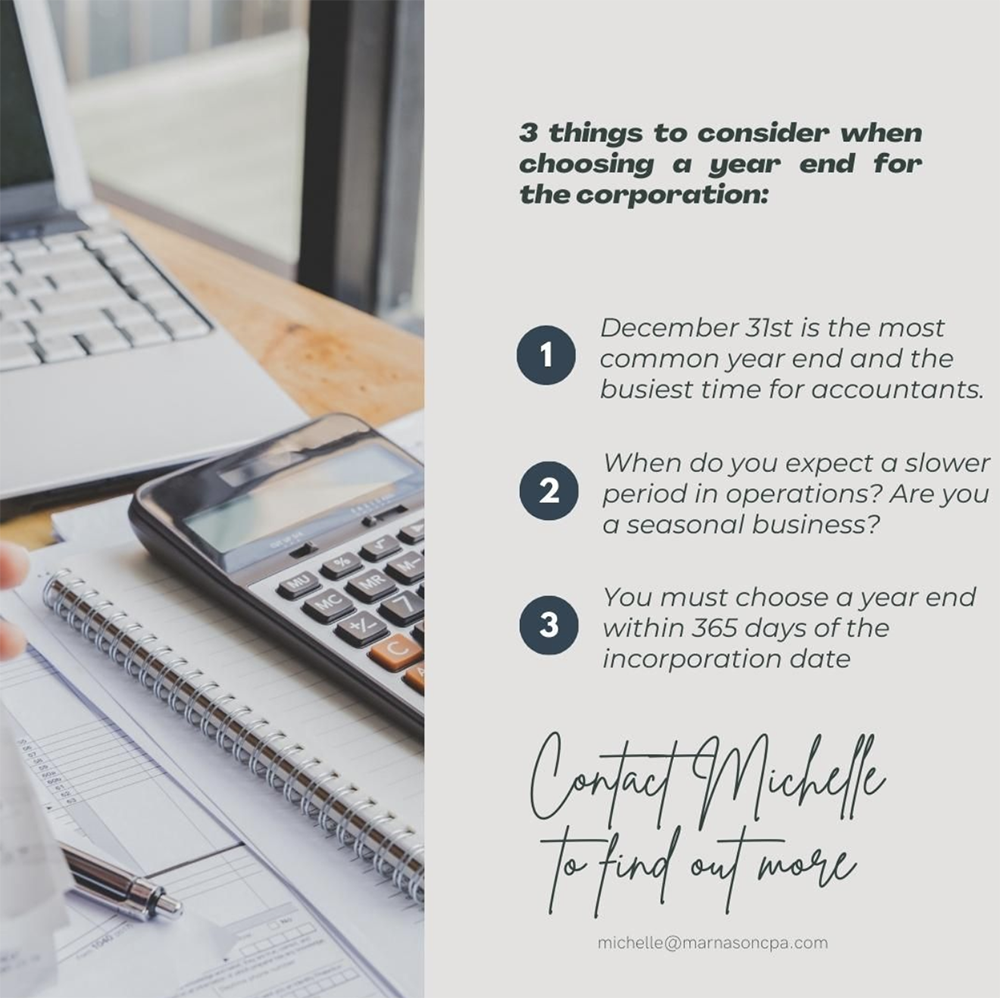

3 things to consider when choosing a year end for the corporation:

Thinking of starting a new business or did you just start one? One of the first steps should always be choosing a corporate year end. The year end can be the last day of any month of the year and there is some key things you should consider before choosing one.

Personal Tax Time Tips & Tricks

Personal Tax Time Tips & Tricks. Here we are in the final stretch of personal tax season and I am sharing my tips and tricks as well as why you should hire a CPA to prepare the tax return.

Do you need a bookkeeper or an accountant?

Do you need a bookkeeper or an accountant? Often, I get asked, what is the difference between a bookkeeper and an accountant? The answer is, a lot, they are two separate but intertwined partners for your business.

Bank and Credit Card Reconciliations

Bank and Credit Card Reconciliations. You know those statements you get every month? The ones you sometimes glace at or quickly file away or even worse, throw away? They are often looked at as secondary, however, they are a very key component of running your business!