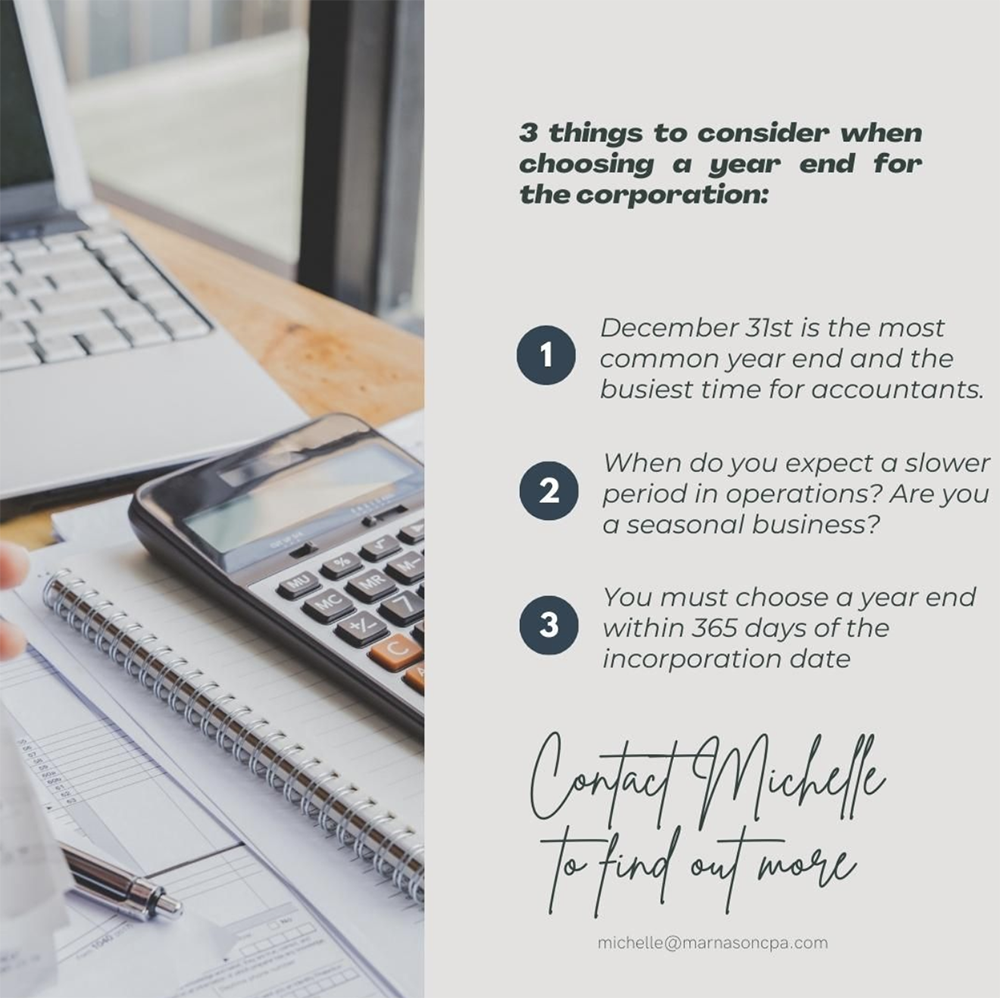

3 things to consider when choosing a year end for the corporation:

Thinking of starting a new business or did you just start one? One of the first steps should always be choosing a corporate year end. The year end can be the last day of any month of the year and there is some key things you should consider before choosing one.

December 31st is the most common year end and the busiest time for accountants.

When do you expect a slower period in operations? Are you a seasonal business?

You must choose a year end within 365 days of the incorporation date