Small Business Budgeting: Unlock Your Business Potential

Budgeting is essential for small business success, providing the financial direction and control needed to achieve your goals. A well-structured budget helps you manage costs, identify funding needs, monitor performance, and support strategic planning. By setting clear financial goals and regularly tracking your expenses, you can ensure your business stays on track and grows sustainably. Need expert support with budgeting? Book a discovery call today to discuss how we can help your business manage its finances and thrive.

Understanding Financial Statements: Key Insights into Your Business Finances

Understanding your financial statements is essential for making informed decisions and guiding your business toward growth and success. Key statements like the balance sheet, income statement, cash flow statement, and statement of retained earnings provide valuable insights into your financial health, profitability, and liquidity. Analyzing these reports helps you assess trends, plan for future growth, and ensure financial stability. Need help interpreting your financial statements? Book a discovery call today to get expert accounting support tailored to your business.

Cash Flow Management Tips for Small Businesses

Cash flow management is crucial for small businesses to maintain financial health and ensure long-term success. By forecasting cash flow, speeding up receivables, controlling expenses, using credit wisely, and building a cash reserve, you can keep your business financially stable and ready for growth. Effective cash flow management can help prevent shortfalls, reduce stress, and give you more control over your financial future. Ready to take charge of your business’s cash flow? Book a discovery call today to learn how professional accounting services can help.

The Benefits of Hiring a CPA: Why Your Business Needs Professional Accounting

As a business owner, hiring a Chartered Professional Accountant (CPA) can be one of your most valuable investments. Learn how a CPA can provide expert financial advice, ensure tax compliance, help with accurate financial reporting, manage cash flow, and support you during a CRA audit. Maximize your business’s growth potential while minimizing risks.

Tax Planning Strategies for Canadian Women Entrepreneurs

As a woman entrepreneur in Canada, effective tax planning is essential for maximizing profitability and securing your financial future. Key strategies to optimize your tax situation include incorporating your business to take advantage of lower corporate tax rates, utilizing the Small Business Deduction to reduce tax on the first $500,000 of active business income, and leveraging available tax credits like the SR&ED credit. Additionally, income splitting can help reduce your overall tax burden by distributing income among family members in lower tax brackets. With the right tax strategy, you can protect your wealth and grow your business more efficiently. Ready to optimize your taxes? Book a discovery call today to craft a personalized tax plan that supports your entrepreneurial goals.

Navigating the CRA: How to Prepare for a Business Audit

A CRA business audit might seem intimidating, but proper preparation can make it manageable. Start by keeping accurate, up-to-date records, including receipts and bank statements, as the CRA can review documents up to six years old. Understand common audit triggers and ensure your records support all claims, particularly for large or unusual expenses. Maintain consistent financial practices and review your tax returns thoroughly before submission. If needed, consult a professional accountant to address any concerns and represent you during the audit.

Stay ahead of the game and avoid audit-related stress. Contact us for comprehensive audit support and tax compliance services. Book your discovery call today to learn how we can help you navigate the audit process with confidence.

Top Tax Deductions for Canadian Small Businesses in 2024

As a Canadian small business owner, understanding and leveraging tax deductions can be a game-changer for your financial success. In 2024, various deductions are available that can significantly lower your taxable income, allowing you to reinvest in your business and achieve your financial goals. From home office expenses to marketing costs, this guide explores the top tax deductions you should be aware of to maximize your savings. Join us as we break down each deduction and provide actionable tips to help you navigate the complexities of tax season with confidence!

The Pros and Cons of Operating as a Sole Proprietor in Canada

Choosing a business structure is crucial for Canadian entrepreneurs. Sole proprietorship offers simplicity and control but comes with risks like personal liability and limited capital access. Weigh the pros and cons carefully.

Setting Your Course to Success: Creating Financial Goals for Your Business

Setting financial goals is crucial for your business's success, providing clarity, motivation, and a way to measure progress. Start by assessing your financial situation through a review of financial statements and key performance indicators. Set SMART goals—specific, measurable, achievable, relevant, and time-bound. Prioritize the most critical goals and break them down into manageable milestones. Assign responsibilities to ensure accountability and set deadlines to maintain focus. Regularly monitor progress and be ready to adapt as needed.

Common Bookkeeping Mistakes to Avoid: A Roadmap to Financial Accuracy

Accurate bookkeeping is the foundation of sound financial management for businesses of all sizes. Properly maintained financial records not only ensure compliance with tax regulations but also provide valuable insights into your company's financial health. Unfortunately, there are a number of bookkeeping mistakes that are commonly made that often lead to financial discrepancies, compliance issues, and missed opportunities. In this blog post, we'll explore some of the most common bookkeeping mistakes and provide you with a roadmap to financial accuracy.

The Art of Expense Tracking: Tips for Efficient Bookkeeping

Effective expense tracking is a fundamental aspect of sound bookkeeping and financial management for any business, large or small. It not only ensures that you have an accurate picture of your financial health but also helps you make informed decisions. In this blog post, we'll delve into the art of expense tracking and provide you with practical tips to streamline this critical aspect of financial management for your business.

Understanding the Canadian Tax Filing Deadlines: A Comprehensive Guide

Tax season in Canada can be a stressful time for individuals and businesses alike. To alleviate some of that stress and ensure you meet your tax obligations without any setbacks, it's essential to have a clear understanding of the Canadian tax filing deadlines. In this comprehensive guide, we'll break down the various tax deadlines in Canada, explain their significance, and offer tips for staying organized and compliant.

Key Tips for Entrepreneurs and Small Business Owners

If you've registered a corporation in Alberta or are considering doing so, it's essential to understand the ongoing compliance requirements. One crucial aspect of maintaining your corporation's status is the annual return. In this blog post, we'll unravel the mysteries surrounding Alberta's annual return requirement, why it's important, and how to fulfill it.

Our Services

WE OFFER: Reliable accounting advice & services for people who own businesses. We also offer personal tax services if you aren't a business owner!

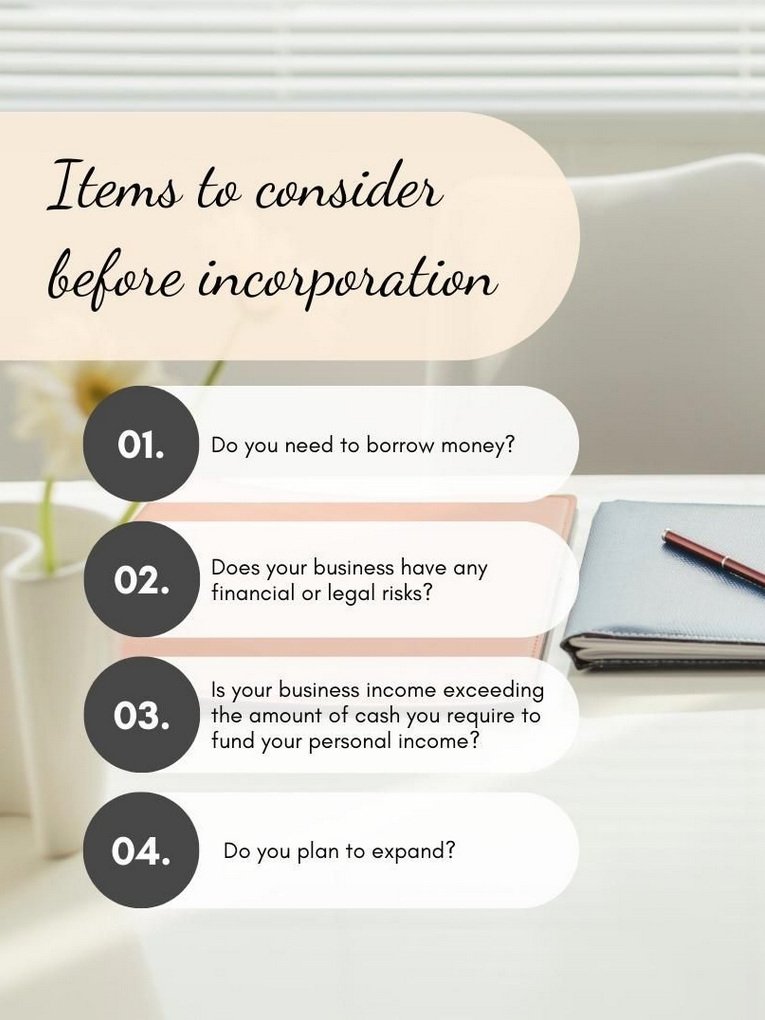

Items to consider before incorporation.

As a corporation, you can be separate from the business and therefore, determine how much income you wish to take from the corporation. You must declare all income that is taken from the entity for yourself personally, to record on a personal tax return. This is done by way of a T4/T5 filing requirement in February each year.

5 things to consider when hiring an accountant

When choosing an accountant, they should be a good fit for your business. Here is a few things to consider when having an initial meeting with an accountant.