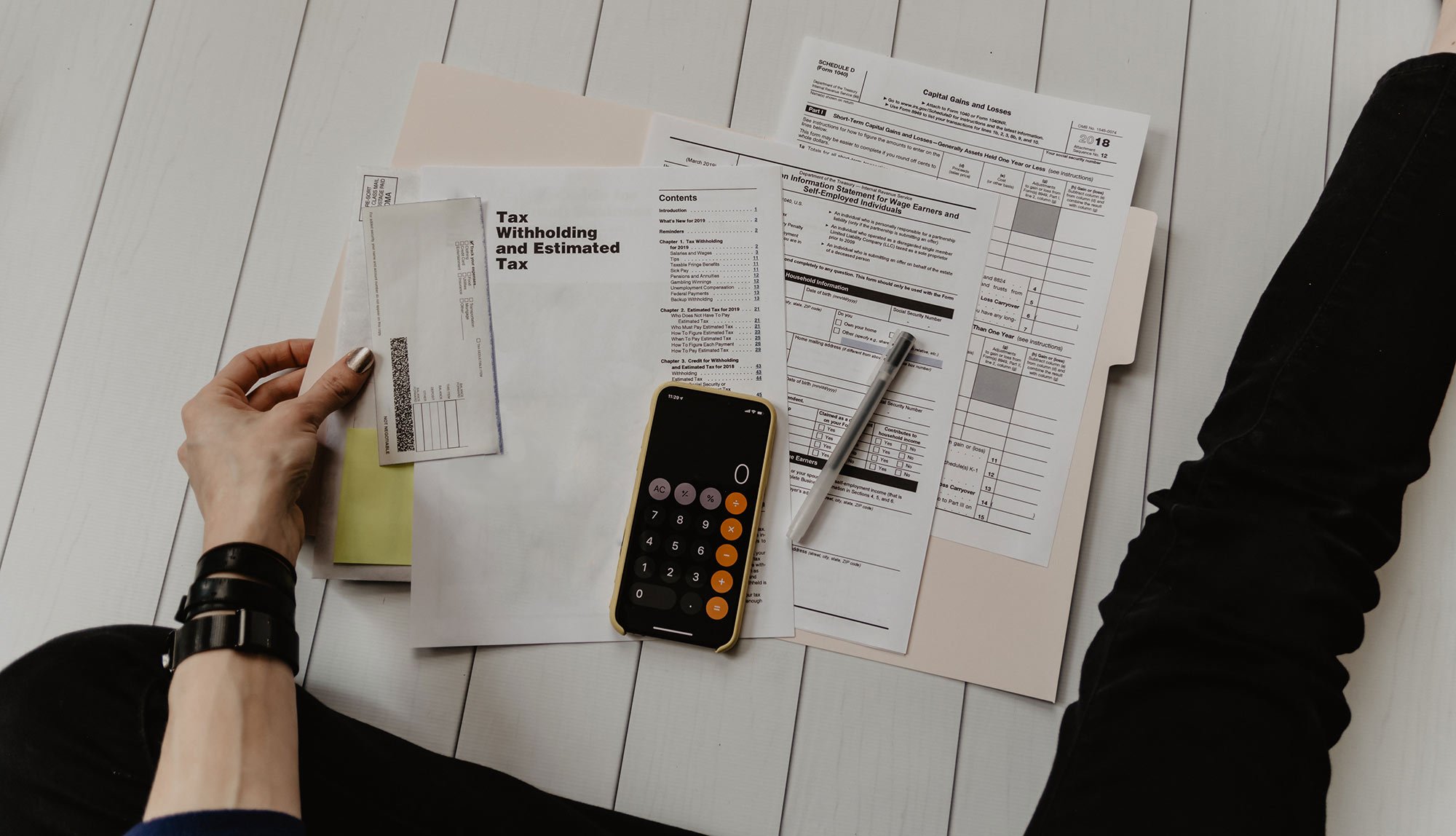

ARE YOU READY TO START

MAKING YOUR LIFE EASIER?

WE OFFER

Reliable accounting advice & services for people who own businesses

Every business is unique.

We know that business is primarily about people, not just numbers… so while we are experts at numbers; we know that our most important role is to help you, the person behind the business.

Someone who will take the time to get to know you and your business.

Someone who is available to answer questions and offer guidance when you need it.

Clear direction and support to help you get your paperwork done timely and correctly.

Pricing clarity so you don’t feel nickel and dimed when you get your invoice.

An accountant who understands where you and your business are today, as well as the vision of your business tomorrow and years ahead.

An accountant with up to date tools, systems and resources.

Confidence that your paperwork will be done on time.

An accountant who will explain your finances in a way you will understand!

If What

you need more of is…

If you answered yes to any of the above, book a discovery call below!

OUR SERVICES

CORPORATE

Taxation

SOLE

Proprietor

BOOK

Keeping

CFO

Advisor

PERSONAL

Taxes

Your TRUSTED NUMBERS GAL

Hi!I’m Michelle.

After spending many years in larger accounting firms in various positions, I soon realized my passion lies with small business owners. When I made the decision to branch off and create my own accounting firm in Airdrie Alberta, I started with nothing but an ambitious goal and a strong desire to change how small business owners felt about the relationship with their accountant. As a business owner myself, I understand some of the challenges you can face and I hope to make this process as easy as possible for you!

Blog

You should never dread meeting with your accountant

In fact, you deserve an accountant that feels like part of your team!

Budgeting is essential for small business success, providing the financial direction and control needed to achieve your goals. A well-structured budget helps you manage costs, identify funding needs, monitor performance, and support strategic planning. By setting clear financial goals and regularly tracking your expenses, you can ensure your business stays on track and grows sustainably. Need expert support with budgeting? Book a discovery call today to discuss how we can help your business manage its finances and thrive.

Understanding your financial statements is essential for making informed decisions and guiding your business toward growth and success. Key statements like the balance sheet, income statement, cash flow statement, and statement of retained earnings provide valuable insights into your financial health, profitability, and liquidity. Analyzing these reports helps you assess trends, plan for future growth, and ensure financial stability. Need help interpreting your financial statements? Book a discovery call today to get expert accounting support tailored to your business.

Cash flow management is crucial for small businesses to maintain financial health and ensure long-term success. By forecasting cash flow, speeding up receivables, controlling expenses, using credit wisely, and building a cash reserve, you can keep your business financially stable and ready for growth. Effective cash flow management can help prevent shortfalls, reduce stress, and give you more control over your financial future. Ready to take charge of your business’s cash flow? Book a discovery call today to learn how professional accounting services can help.

As a business owner, hiring a Chartered Professional Accountant (CPA) can be one of your most valuable investments. Learn how a CPA can provide expert financial advice, ensure tax compliance, help with accurate financial reporting, manage cash flow, and support you during a CRA audit. Maximize your business’s growth potential while minimizing risks.

As a woman entrepreneur in Canada, effective tax planning is essential for maximizing profitability and securing your financial future. Key strategies to optimize your tax situation include incorporating your business to take advantage of lower corporate tax rates, utilizing the Small Business Deduction to reduce tax on the first $500,000 of active business income, and leveraging available tax credits like the SR&ED credit. Additionally, income splitting can help reduce your overall tax burden by distributing income among family members in lower tax brackets. With the right tax strategy, you can protect your wealth and grow your business more efficiently. Ready to optimize your taxes? Book a discovery call today to craft a personalized tax plan that supports your entrepreneurial goals.

Scaling your business requires meticulous financial planning. Start by assessing your current financial position to identify any weaknesses. Forecast your future revenue using historical data and market trends to set realistic expectations. Identify and prioritize growth-related expenses, such as hiring and technology investments. Manage your cash flow effectively with strategies like negotiating payment terms and securing credit. Regularly review your performance against your budget and make adjustments as needed.

A CRA business audit might seem intimidating, but proper preparation can make it manageable. Start by keeping accurate, up-to-date records, including receipts and bank statements, as the CRA can review documents up to six years old. Understand common audit triggers and ensure your records support all claims, particularly for large or unusual expenses. Maintain consistent financial practices and review your tax returns thoroughly before submission. If needed, consult a professional accountant to address any concerns and represent you during the audit.

Stay ahead of the game and avoid audit-related stress. Contact us for comprehensive audit support and tax compliance services. Book your discovery call today to learn how we can help you navigate the audit process with confidence.

As a Canadian small business owner, understanding and leveraging tax deductions can be a game-changer for your financial success. In 2024, various deductions are available that can significantly lower your taxable income, allowing you to reinvest in your business and achieve your financial goals. From home office expenses to marketing costs, this guide explores the top tax deductions you should be aware of to maximize your savings. Join us as we break down each deduction and provide actionable tips to help you navigate the complexities of tax season with confidence!

Choosing a business structure is crucial for Canadian entrepreneurs. Sole proprietorship offers simplicity and control but comes with risks like personal liability and limited capital access. Weigh the pros and cons carefully.

As a business owner, understanding your financial performance is essential. In this blog, we delve into five key financial reports: the income statement, balance sheet, cash flow statement, accounts receivable aging report, and accounts payable aging report. By mastering these reports, you'll make informed decisions, manage cash flow effectively, and maintain financial stability, steering your business toward greater success.

Setting financial goals is crucial for your business's success, providing clarity, motivation, and a way to measure progress. Start by assessing your financial situation through a review of financial statements and key performance indicators. Set SMART goals—specific, measurable, achievable, relevant, and time-bound. Prioritize the most critical goals and break them down into manageable milestones. Assign responsibilities to ensure accountability and set deadlines to maintain focus. Regularly monitor progress and be ready to adapt as needed.

Accurate bookkeeping is the foundation of sound financial management for businesses of all sizes. Properly maintained financial records not only ensure compliance with tax regulations but also provide valuable insights into your company's financial health. Unfortunately, there are a number of bookkeeping mistakes that are commonly made that often lead to financial discrepancies, compliance issues, and missed opportunities. In this blog post, we'll explore some of the most common bookkeeping mistakes and provide you with a roadmap to financial accuracy.

Effective expense tracking is a fundamental aspect of sound bookkeeping and financial management for any business, large or small. It not only ensures that you have an accurate picture of your financial health but also helps you make informed decisions. In this blog post, we'll delve into the art of expense tracking and provide you with practical tips to streamline this critical aspect of financial management for your business.

Effective bookkeeping is the cornerstone of financial management for any small business. With the help of modern bookkeeping software, small business owners can streamline financial tasks, improve accuracy, and gain valuable insights into their financial health. However, with a multitude of bookkeeping software options available, selecting the right one can be a daunting task. In this blog post, we will help guide you through the process of choosing the best bookkeeping software for your small business.

Payroll management is a critical function for businesses of all sizes. It involves calculating and disbursing employee wages, ensuring compliance with tax regulations, and keeping accurate records. Many companies will need to decide whether they want to manage payroll in-house, or outsource it to a specialized provider. In this blog post, we'll explore the pros and cons of outsourcing payroll to help you make an informed choice for your business.

Tax season in Canada can be a stressful time for individuals and businesses alike. To alleviate some of that stress and ensure you meet your tax obligations without any setbacks, it's essential to have a clear understanding of the Canadian tax filing deadlines. In this comprehensive guide, we'll break down the various tax deadlines in Canada, explain their significance, and offer tips for staying organized and compliant.

For employers in Canada, the 2023 tax year introduces new requirements for T4 and T4A reporting that directly impact the Canadian Dental Care Plan.

If you've registered a corporation in Alberta or are considering doing so, it's essential to understand the ongoing compliance requirements. One crucial aspect of maintaining your corporation's status is the annual return. In this blog post, we'll unravel the mysteries surrounding Alberta's annual return requirement, why it's important, and how to fulfill it.

Managing your small business's financial records is a critical task that can significantly impact your company's success. When it comes to bookkeeping, you have two primary options: outsourcing the task to a professional bookkeeping service or handling it in-house with your own team. Each approach has its own set of advantages and disadvantages. In this blog post, we'll explore the pros and cons of both outsourcing and in-house bookkeeping to help you make an informed decision about which approach best suits your business.

If you've registered a corporation in Alberta or are considering doing so, it's essential to understand the ongoing compliance requirements. One crucial aspect of maintaining your corporation's status is the annual return. In this blog post, we'll unravel the mysteries surrounding Alberta's annual return requirement, why it's important, and how to fulfill it.

Personal Service Businesses (PSBs) are a distinct category of businesses in Canada with unique tax implications. They are defined by the Canada Revenue Agency (CRA) based on specific criteria that differentiate them from other types of businesses. In this blog post, we'll delve into the CRA's criteria for classifying a business as a personal service business and explore the tax implications that come with this classification.

Personal Tax Time Tips & Tricks. Here we are in the final stretch of personal tax season and I am sharing my tips and tricks as well as why you should hire a CPA to prepare the tax return.

WE OFFER: Reliable accounting advice & services for people who own businesses. We also offer personal tax services if you aren't a business owner!

Should you be paying yourself a salary or dividends? The answer is... IT DEPENDS. Each business owner has different priorities, and both have advantages and disadvantages. Below are the advantages and disadvantages of both.

Lets develop a system which handles your bookkeeping whether you are just starting out or you are trying to get back on track, here is the steps to get your on the right track.

Putting off the bookkeeping will start to pile up and become a unmanageable task. This can lead to late filings and expensive penalties from the Canada Revenue Agency. Let’s avoid those penalties and put those funds back into growing the business!

The truth is, good bookkeeping is powerful! Let us show you the difference. We try to make this process easy for you and work with you to come up with the best solution for your needs. Every business is unique, and your bookkeeping services should be too.

The truth is, good bookkeeping is powerful! Let us show you the difference. We try to make this process easy for you and work with you to come up with the best solution for your needs. Every business is unique, and your bookkeeping services should be too.

How do you pay yourself from the corporation? Did you know it could be a mix of both and it should be based on your business and goals.

Set yourself up for success in Q4. First, get the bookkeeping caught up and then make a plan how to distribute any additional profit in 2022 or 2023.