Common Bookkeeping Mistakes to Avoid: A Roadmap to Financial Accuracy

Accurate bookkeeping is the foundation of sound financial management for businesses of all sizes. Properly maintained financial records not only ensure compliance with tax regulations but also provide valuable insights into your company's financial health. Unfortunately, there are a number of bookkeeping mistakes that are commonly made that often lead to financial discrepancies, compliance issues, and missed opportunities. In this blog post, we'll explore some of the most common bookkeeping mistakes and provide you with a roadmap to financial accuracy.

The Art of Expense Tracking: Tips for Efficient Bookkeeping

Effective expense tracking is a fundamental aspect of sound bookkeeping and financial management for any business, large or small. It not only ensures that you have an accurate picture of your financial health but also helps you make informed decisions. In this blog post, we'll delve into the art of expense tracking and provide you with practical tips to streamline this critical aspect of financial management for your business.

The Art of Expense Tracking: Tips for Efficient Bookkeeping

Putting off the bookkeeping will start to pile up and become a unmanageable task. This can lead to late filings and expensive penalties from the Canada Revenue Agency. Let’s avoid those penalties and put those funds back into growing the business!

Stress free solutions for small businesses: Part 2 - FAQs

The truth is, good bookkeeping is powerful! Let us show you the difference. We try to make this process easy for you and work with you to come up with the best solution for your needs. Every business is unique, and your bookkeeping services should be too.

Stress free solutions for small businesses: Part 1 - The Process

The truth is, good bookkeeping is powerful! Let us show you the difference. We try to make this process easy for you and work with you to come up with the best solution for your needs. Every business is unique, and your bookkeeping services should be too.

How do you pay yourself from the corporation?

How do you pay yourself from the corporation? Did you know it could be a mix of both and it should be based on your business and goals.

Forth Quarter

Set yourself up for success in Q4. First, get the bookkeeping caught up and then make a plan how to distribute any additional profit in 2022 or 2023.

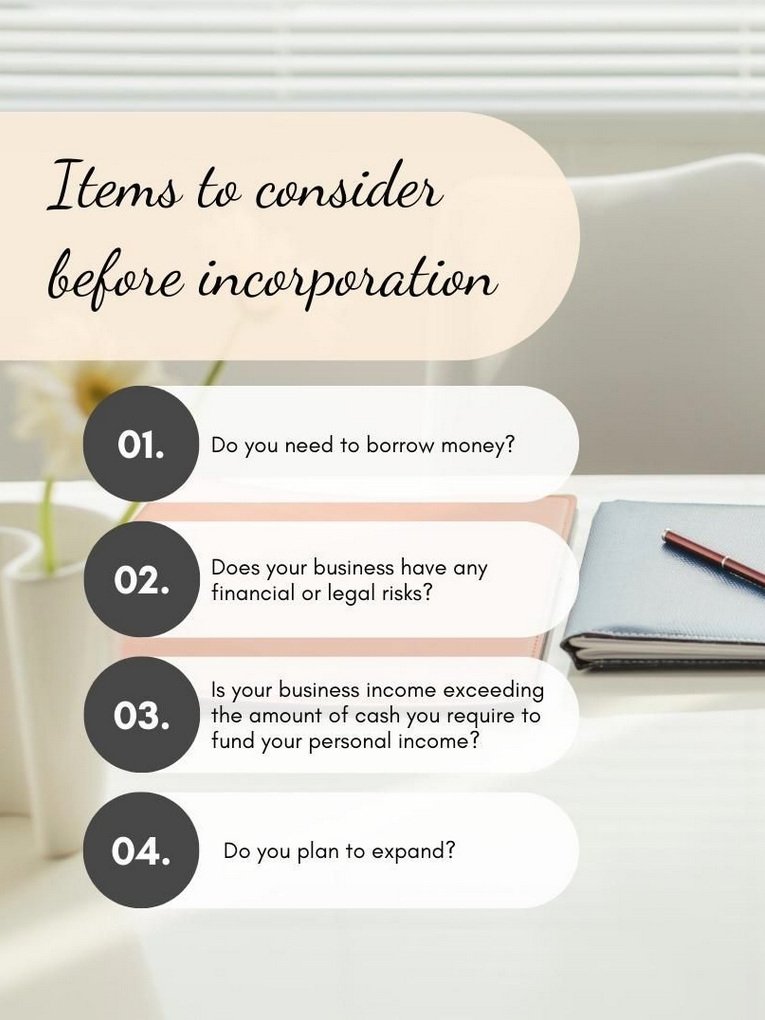

Items to consider before incorporation.

As a corporation, you can be separate from the business and therefore, determine how much income you wish to take from the corporation. You must declare all income that is taken from the entity for yourself personally, to record on a personal tax return. This is done by way of a T4/T5 filing requirement in February each year.

What to provide the accountant at year end.

What to provide the accountant at year end. Ever wonder what you should be providing to the accountant with your year end? Here is a quick snapshot of what an accountant needs.

Business Expenses - Motor Vehicle Expenses

You can deduct expenses you incur to run a motor vehicle that you use to earn business income. However, several factors can affect your deduction and the supporting documentation required does depend on the business structure.

5 things to consider when hiring an accountant

When choosing an accountant, they should be a good fit for your business. Here is a few things to consider when having an initial meeting with an accountant.

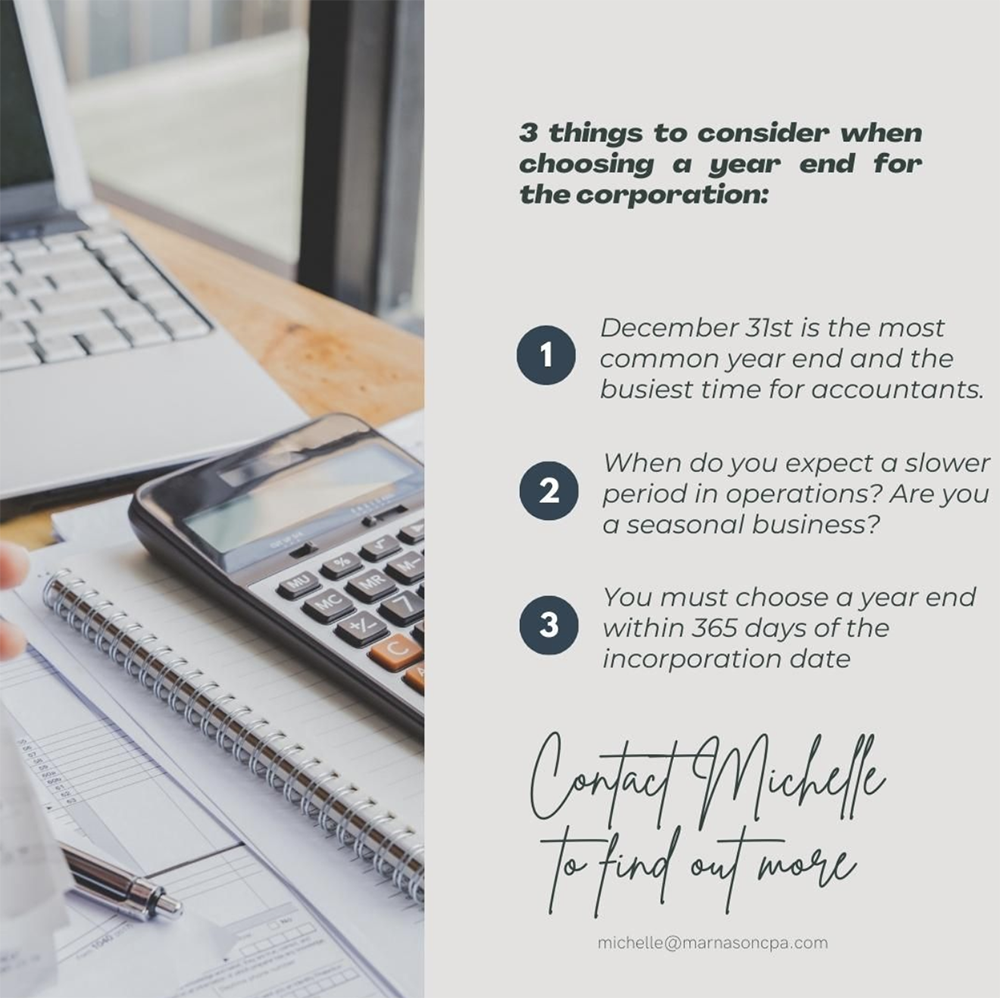

3 things to consider when choosing a year end for the corporation:

Thinking of starting a new business or did you just start one? One of the first steps should always be choosing a corporate year end. The year end can be the last day of any month of the year and there is some key things you should consider before choosing one.