Small Business Budgeting: Unlock Your Business Potential

Budgeting is essential for small business success, providing the financial direction and control needed to achieve your goals. A well-structured budget helps you manage costs, identify funding needs, monitor performance, and support strategic planning. By setting clear financial goals and regularly tracking your expenses, you can ensure your business stays on track and grows sustainably. Need expert support with budgeting? Book a discovery call today to discuss how we can help your business manage its finances and thrive.

Understanding Financial Statements: Key Insights into Your Business Finances

Understanding your financial statements is essential for making informed decisions and guiding your business toward growth and success. Key statements like the balance sheet, income statement, cash flow statement, and statement of retained earnings provide valuable insights into your financial health, profitability, and liquidity. Analyzing these reports helps you assess trends, plan for future growth, and ensure financial stability. Need help interpreting your financial statements? Book a discovery call today to get expert accounting support tailored to your business.

Cash Flow Management Tips for Small Businesses

Cash flow management is crucial for small businesses to maintain financial health and ensure long-term success. By forecasting cash flow, speeding up receivables, controlling expenses, using credit wisely, and building a cash reserve, you can keep your business financially stable and ready for growth. Effective cash flow management can help prevent shortfalls, reduce stress, and give you more control over your financial future. Ready to take charge of your business’s cash flow? Book a discovery call today to learn how professional accounting services can help.

The Benefits of Hiring a CPA: Why Your Business Needs Professional Accounting

As a business owner, hiring a Chartered Professional Accountant (CPA) can be one of your most valuable investments. Learn how a CPA can provide expert financial advice, ensure tax compliance, help with accurate financial reporting, manage cash flow, and support you during a CRA audit. Maximize your business’s growth potential while minimizing risks.

Tax Planning Strategies for Canadian Women Entrepreneurs

As a woman entrepreneur in Canada, effective tax planning is essential for maximizing profitability and securing your financial future. Key strategies to optimize your tax situation include incorporating your business to take advantage of lower corporate tax rates, utilizing the Small Business Deduction to reduce tax on the first $500,000 of active business income, and leveraging available tax credits like the SR&ED credit. Additionally, income splitting can help reduce your overall tax burden by distributing income among family members in lower tax brackets. With the right tax strategy, you can protect your wealth and grow your business more efficiently. Ready to optimize your taxes? Book a discovery call today to craft a personalized tax plan that supports your entrepreneurial goals.

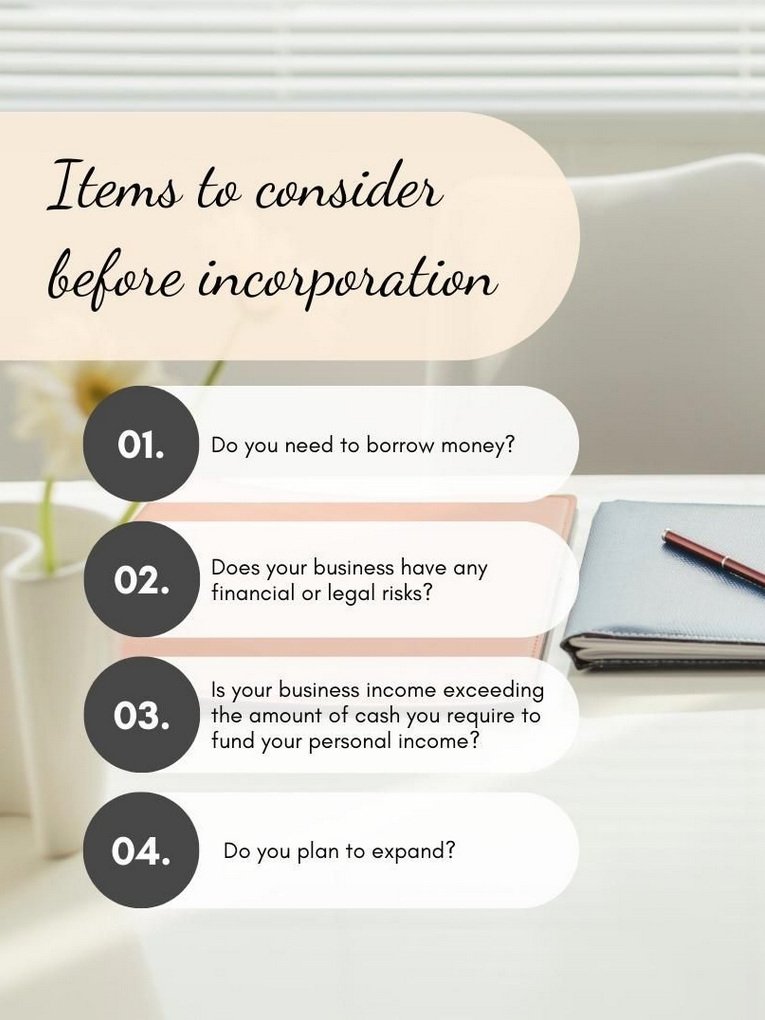

Items to consider before incorporation.

As a corporation, you can be separate from the business and therefore, determine how much income you wish to take from the corporation. You must declare all income that is taken from the entity for yourself personally, to record on a personal tax return. This is done by way of a T4/T5 filing requirement in February each year.

5 things to consider when hiring an accountant

When choosing an accountant, they should be a good fit for your business. Here is a few things to consider when having an initial meeting with an accountant.